All Categories

Featured

Table of Contents

[/image][=video]

[/video]

If you're in great health and wellness and willing to go through a clinical examination, you may certify for conventional life insurance policy at a much lower price. Surefire issue life insurance policy is frequently unneeded for those in excellent health and can pass a medical test. Due to the fact that there's no medical underwriting, also those healthy pay the very same costs as those with wellness concerns.

Provided the reduced coverage quantities and higher premiums, assured issue life insurance coverage might not be the very best option for long-term monetary planning. It's commonly a lot more fit for covering final costs as opposed to replacing earnings or significant financial debts. Some guaranteed issue life insurance policy plans have age restrictions, commonly restricting candidates to a details age array, such as 50 to 80.

Ensured problem life insurance policy comes with greater premium prices compared to clinically underwritten policies, yet prices can vary considerably depending on factors like:: Different insurance companies have various rates designs and might provide various rates.: Older candidates will certainly pay greater premiums.: Ladies commonly have reduced prices than guys of the same age.

: The death advantage amount impacts costs. A $25,000 policy costs less than a $50,000 policy.: Paying premiums regular monthly costs much more overall than quarterly or annual payments.: Whole life costs are higher general than term life insurance policies. While the guaranteed concern does come at a rate, it offers important coverage to those who may not receive traditionally underwritten plans.

Guaranteed problem life insurance policy and simplified problem life insurance policy are both sorts of life insurance policy that do not call for a medical test. There are some vital differences in between the 2 kinds of policies. is a sort of life insurance policy that does not need any kind of wellness inquiries to be answered.

Some Known Incorrect Statements About No Medical Exam Life Insurance For Seniors Over 75

Guaranteed-issue life insurance policy plans typically have higher costs and reduced death benefits than traditional life insurance policies. The health and wellness inquiries are generally less thorough than those asked for standard life insurance coverage plans.

Immediate life insurance policy protection is coverage you can obtain an instant response on. Your plan will certainly begin as quickly as your application is accepted, meaning the entire process can be done in less than half an hour.

Several web sites are appealing split second insurance coverage that starts today, however that doesn't indicate every candidate will certify. Commonly, consumers will submit an application believing it's for instantaneous protection, just to be met with a message they require to take a medical test.

The same details was then made use of to approve or reject your application. When you request a sped up life insurance policy plan your information is assessed quickly. A computer algorithm evaluates the information from your application in addition to info concerning you from credit rating reporting firms, the DMV, the Medical Info Bureau, and information solutions like LexisNexis.

You'll after that get instantaneous approval, instant being rejected, or discover you need to take a medical exam. You could require to take a medical exam if your application or the data pulled about you expose any kind of health and wellness problems or issues. There are several choices for instant life insurance policy. It is essential to note that while many traditional life insurance coverage firms deal sped up underwriting with fast approval, you might require to experience a representative to apply.

Getting The Best No Exam Life Insurance Companies Of 2025 To Work

The firms listed below deal entirely on-line, straightforward alternatives. The firm uses adaptable, immediate plans to individuals in between 18 and 60. Ladder policies permit you to make changes to your coverage over the life of your plan if your demands transform.

The company supplies policies to applications in between 21 and 55 for a ten-year term, and between 21 and 45 for a 20-year term. Values policies are backed by Legal and General America.

Much like Ladder, you might require to take a medical exam when you make an application for coverage with Values. The business says that the bulk of applicants can get protection without an examination. Unlike Ladder, your Values plan will not begin as soon as possible if you require an exam. You'll need to wait till your exam outcomes are back to obtain a cost and get protection.

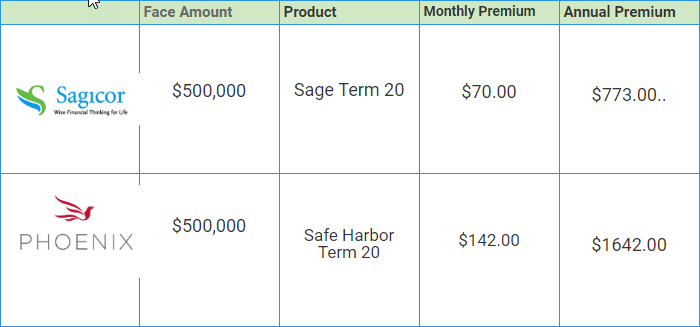

In various other cases, you'll need to supply more information or take a clinical test. Here is a cost contrast of insant life insurance policy for a 50 year old man in good health.

Many people begin the life insurance policy acquiring plan by obtaining a quote. Let's say you obtained a quote for $50 a month for a $500,000, 20-year policy.

Greater advantage amounts and longer terms will certainly increase your life insurance policy rates, while reduced benefit quantities and shorter terms will certainly lower them. You can set the exact protection you're looking for and after that begin your application. A life insurance policy application will certainly ask you for a great deal of info. You'll need to supply your health and wellness background and your family health history.

The Of Best Cheap No-exam Life Insurance For Term & Whole Life

If the firm locates you really did not reveal information, your plan might be denied. The decrease can be mirrored in your insurance policy score, making it harder to get coverage in the future.

A simplified underwriting policy will ask you comprehensive inquiries about your medical background and recent treatment throughout your application. An instantaneous problem plan will certainly do the same, but with the difference in underwriting you can obtain an instant choice. There are several differences between surefire issue and instantaneous life insurance policy.

Second, the coverage quantities are reduced, however the costs are frequently greater. And also, guaranteed concern plans aren't able to be made use of throughout the waiting period. This indicates you can't access the full fatality benefit quantity for a collection amount of time. For many policies, the waiting period is 2 years.

If you're in great health and can certify, an immediate problem policy will certainly enable you to obtain insurance coverage with no examination and no waiting duration. In that situation, a simplified issue plan with no examination could be best for you.

The Definitive Guide for Best No-exam Life Insurance Companies (2025)

Simplified concern plans will certainly take a few days, while immediate plans are, as the name indicates, immediate. Acquiring an instant policy can be a fast and easy procedure, yet there are a couple of points you must keep an eye out for. Before you hit that acquisition switch make certain that: You're getting a term life plan and not an unintended fatality plan.

They do not offer protection for health problem. Some firms will certainly issue you an accidental fatality plan instantaneously but require you to take a test for a term life policy. You have actually checked out the small print. Some websites contain vibrant images and vibrant guarantees. Make sure you review all the details.

Your agent has actually responded to all your inquiries. Much like websites, some agents emphasize they can get you covered today without explaining or supplying you the information you need.

Table of Contents

Latest Posts

Getting The Gerber Life Insurance: Family Life Insurance Policies To Work

Not known Details About The Top 15 No Exam Life Insurance Companies

Guaranteed Issue Life Insurance Quotes - No Health ... Things To Know Before You Get This

More

Latest Posts

Getting The Gerber Life Insurance: Family Life Insurance Policies To Work

Not known Details About The Top 15 No Exam Life Insurance Companies

Guaranteed Issue Life Insurance Quotes - No Health ... Things To Know Before You Get This